A Definitive Guide to Travel Insurance for Adventure Travel

Travel insurance for an expedition isn't just another box to tick. It’s a specialised shield designed for the high-stakes world of remote exploration, covering essentials like emergency medical evacuation , search and rescue operations , and the loss of expensive, specialised equipment .

Your standard holiday policy, the one you’d buy for a week on the coast, is completely out of its depth in the environments we operate in. Relying on it will almost certainly leave you dangerously exposed when you need support the most.

Why Your Standard Holiday Insurance is Useless for Expeditions

Picture this: you’re on a glacier in Svalbard, 20 kilometres from the nearest outpost, and something goes wrong. A standard travel policy is built for predictable problems—a delayed flight from Heathrow, a lost suitcase in Malaga, a stomach upset you can treat in a city hospital. It’s simply not designed for the realities of a polar environment.

This isn't a minor detail in the small print; it's the entire foundation of proper risk management. Insurers draw a very thick, clear line between ‘leisure travel’ and what they rightly classify as ‘adventure travel’ or ‘hazardous activities’.

The Critical Gaps in Standard Policies

Standard policies are riddled with exclusions that directly contradict the nature of expedition life. They are written with a core assumption of easy access and conventional risk, neither of which apply to our world.

A typical holiday policy will almost certainly refuse to cover you for:

- Specific Activities: Activities like ski touring, polar travel, glacier crossings, and mountaineering are almost universally excluded from basic plans. They are seen as specialist risks.

- Geographical Remoteness: Many policies have clauses that invalidate cover if you are in a location without immediate access to recognised medical facilities. That’s almost every place we go.

- Search and Rescue: This is a separate and incredibly expensive operation. It’s rarely included in standard plans, which might cover getting you home from a hospital, but not the cost of finding you in the first place.

- Specialised Equipment: The value of a pulk, a Hilleberg four-season tent, or a satellite phone far exceeds the low per-item limits of a normal policy.

Choosing the right insurance isn't a bureaucratic chore; it's a critical piece of mission planning. It's as vital as your layering system or your communications device. It shows a professional approach to risk—a mindset we instil in every participant on our Pole to Pole expedition training course.

"Proper insurance is the foundation of competent risk mitigation. It acknowledges the environment's realities and ensures a robust support structure is in place, should the unforeseen happen."

Consider the logistics of organising an emergency response. Having reliable communication is vital, especially for mission-critical communication for Land Search and Rescue operations. This is precisely the kind of complex scenario that standard insurance is unprepared to handle.

An expedition policy, on the other hand, is built for exactly this. It provides the financial and logistical backbone for a safe, responsible, and successful journey.

Decoding What Makes an Expedition Policy Work

Realising your standard holiday insurance won't suffice is the first hurdle. The next is knowing what a proper expedition policy actually looks like. A robust travel insurance for adventure travel isn't about unnecessary extras; it’s built on a foundation of non-negotiable protections designed for remote, high-stakes environments.

Think of these components as the pillars holding up your safety net. If any of them are missing or weak, the whole structure is useless. Let’s break down the five critical areas you have to get right.

Medical Expenses

This is the absolute baseline, but the scale of cover needed is often misunderstood. A broken arm in Spain is one thing; a serious injury in the Arctic is a different financial universe. Your policy must have a high limit for medical expenses, somewhere in the ballpark of £5 million to £10 million .

That number isn’t arbitrary. It’s a realistic reflection of the cost of long hospital stays, specialist care, and the logistics of getting that care in places with almost no infrastructure. Consider it the minimum entry fee for a credible policy.

Emergency Medical Evacuation and Repatriation

This is, without doubt, the most critical and expensive part of any expedition policy. It covers the cost of getting you from where the incident occurred to a hospital that can treat you, and eventually, getting you home to the UK. An airlift from the Antarctic plateau or the Greenland ice cap can easily run into hundreds of thousands of pounds.

"A policy's value is tested not with a lost bag, but with a medical emergency at 80° North. The evacuation limit is not a theoretical number; it's the real-world cost of a helicopter, a medical team, and a flight home."

When you look at this section, you need to understand exactly what it covers. For a deeper dive, it’s worth reading this guide on how emergency air evacuation insurance explained , which lays out the costs and specific details.

Search and Rescue

It is vital to understand that Search and Rescue (SAR) is not the same as medical evacuation. Evacuation is what happens after you’ve been found and stabilised. SAR is the mission to find you in the first place.

Many insurers roll this into their medical evacuation limit, which is acceptable, but you must check the wording to see that it’s explicitly included. Deploying helicopters and rescue teams in a polar environment is extremely costly, and your policy has to cover this critical first step.

Trip Cancellation and Interruption

Expeditions are a significant financial and emotional investment, often paid for months, if not years, in advance. A good cancellation clause protects you if something unexpected—like an injury during training or a family emergency—forces you to pull out.

In the same way, trip interruption cover handles the costs if you have to abandon the expedition halfway through. It ensures you’re not left completely out of pocket if life gets in the way and cuts your journey short.

Baggage and Equipment Cover

On an expedition, your equipment is your lifeline. A standard policy that pays out a few hundred pounds for a lost suitcase is laughable when your pulk, tent, and technical clothing are worth thousands.

You need a policy with a high single-item limit and a total equipment value that actually reflects what you’re carrying. You have to make the insurer understand you’re not taking holiday luggage; this is specialist life-support equipment. Without it, a simple baggage handling mistake could end your expedition before it even starts.

Navigating Activity Exclusions and Policy Endorsements

The most common reason an insurance claim is rejected is buried deep inside the policy wording. It’s a section called the activity exclusion clause , and it’s where insurers list everything they refuse to cover. For a Pole to Pole expedition, this isn’t fine print; it's the most important part of the entire document.

Insurers group activities based on risk. Your standard holiday policy is built for low-risk scenarios, like lying on a beach. Anything that falls outside that box is automatically excluded. This is not a grey area. Your average policy will absolutely not cover you for skiing across glaciers, climbing mountains, or travelling in polar regions.

The document isn't written to trick you, but it is written in precise legal language that demands your full attention. Assuming you’re covered is the fastest way to find out you are not.

Understanding Common Adventure Exclusions

When you start digging into the wording, you’ll find specific phrases that should set alarm bells ringing. Insurers often exclude the very activities that form the backbone of our expeditions. It’s on you to find a policy that explicitly includes them, not just one that fails to mention them. Silence is not consent here.

Keep an eye out for exclusions related to:

- Ski Touring or Off-Piste Skiing: Many winter sports policies only cover you within the marked boundaries of a ski resort. By definition, our expeditions happen miles from any of that.

- High-Altitude Trekking: Insurers often set an altitude limit, sometimes as low as 2,000 metres (approx. 6,560 feet). Going above that without the right cover makes your policy worthless.

- Use of Specialist Equipment: The moment crampons, ice axes, or ropes are mentioned, it can trigger an exclusion. These tools signal a level of risk standard policies are not priced for.

- Polar Regions: Policies nearly always have geographical exclusions, and the Arctic and Antarctic are top of that list. You need to make sure your destination, whether it's Svalbard or the South Pole, is specifically named and covered.

If you don't check these points, you are, for all intents and purposes, travelling without insurance. An invalid policy is just an expensive piece of paper.

The Role of a Policy Endorsement

This brings us to a critical term: the ‘endorsement’ . An endorsement—sometimes called a rider or an add-on—is the formal process of adding a specific, otherwise excluded activity to your policy. It’s a written agreement from the insurer stating, “Yes, we will cover you for this exact hazardous activity.”

An endorsement isn't a vague chat with someone on the phone. It is a contractual amendment to your policy that explicitly names the activity (e.g., ‘Last Degree South Pole Ski Expedition’) and confirms it is covered. Without this in writing, you have no real protection.

This almost always costs more, and rightly so. The extra premium reflects the much higher risk the underwriter is taking on. This is not the place to try and save a few pounds. That extra cost is the price of genuine, functional travel insurance for adventure travel .

To illustrate the gap between standard and specialist cover, let's look at a side-by-side comparison for a typical expedition member.

Standard vs. Specialist Adventure Policy Comparison

| Coverage Feature | Standard Holiday Policy | Specialist Adventure Policy |

|---|---|---|

| Activity Coverage | Excludes off-piste skiing, mountaineering, and polar travel. | Explicitly covers ski touring, use of technical equipment, and high-altitude trekking via endorsement. |

| Medical Evacuation | Capped at a low limit (e.g., £1-2m), often excluding remote areas. | High limits (£5m-£10m+), including search, rescue, and evacuation from polar regions. |

| Geographical Limits | Excludes Arctic/Antarctic regions as standard. | Destination (e.g., 'Antarctic Plateau') named and covered in the policy schedule. |

| Equipment Cover | Low single-item limits; excludes specialist equipment like pulks or expedition skis. | High-value cover for specified technical equipment, often with a higher overall limit. |

| Altitude Limit | Often restricted to below 2,000m. | Covers altitudes relevant to the expedition (e.g., up to 3,000m for the South Pole). |

The difference is night and day. A standard policy is built for a world we do not operate in; a specialist one is designed for it.

When you speak to an insurer, be direct. Don't ask, "Am I covered for a skiing trip?" Ask, "Does this policy cover a 10-day, unsupported ski-touring expedition on the glaciers of Svalbard, using pulks in a remote environment?" The more detail you give, the clearer the answer will be. A credible insurer won't hesitate to provide a written endorsement spelling out exactly what’s included. That clarity is non-negotiable.

How to Properly Assess Providers and Policy Wording

Picking the right insurance provider is as critical as choosing the right ice axe. The market is crowded, and the headline prices on comparison sites mean very little. A cheap policy often signals dangerously thin cover, which is a liability, not an asset. Real competence lies in looking past the marketing slogans to see the substance of the provider and the policy they are offering.

This process doesn’t start on a price comparison website. It starts with a hard look at a company’s reputation. You need to seek out specialists in this field—names like Dogtag, World Nomads, or policies underwritten by seasoned experts like Campbell Irvine are a good place to begin. These organisations understand the fundamental difference between a holiday and an expedition.

Evaluating the Provider Beyond the Price Tag

A provider’s true worth is only proven when something goes wrong. That means your assessment has to focus on their ability to operate in a crisis, not just the cost of the premium.

First, check the underwriter’s reputation. They are the ones ultimately financially responsible. Then, start digging into customer reviews, but filter them. A five-star review for a simple lost baggage claim in Paris is irrelevant to you. You need to find accounts from travellers who needed serious assistance in environments similar to where you are headed.

Finally, investigate the 24/7 emergency assistance company they partner with. Who are they? Do they have a proven track record of coordinating evacuations from places like Svalbard or the Antarctic interior? A phone call to ask them directly about their experience in these regions can be very revealing. This is a core part of your own due diligence—a central tenet of self-reliance we value at Pole to Pole. You can learn more about this methodical approach in our guide to planning an expedition .

Reading the Policy Wording Like an Expedition Plan

Think of the Policy Wording document as your map. Ignoring it is like setting off into a whiteout without a compass. It’s dense, but three sections demand your absolute focus: Definitions , Exclusions , and the Claims Procedure .

The definitions section is critical because it clarifies what terms like "Medical Emergency" or "High-Altitude" legally mean in their world. The exclusions section, as we’ve discussed, is where the hidden tripwires are buried. And the claims procedure outlines your exact obligations in an emergency—miss a step, and you could invalidate your claim.

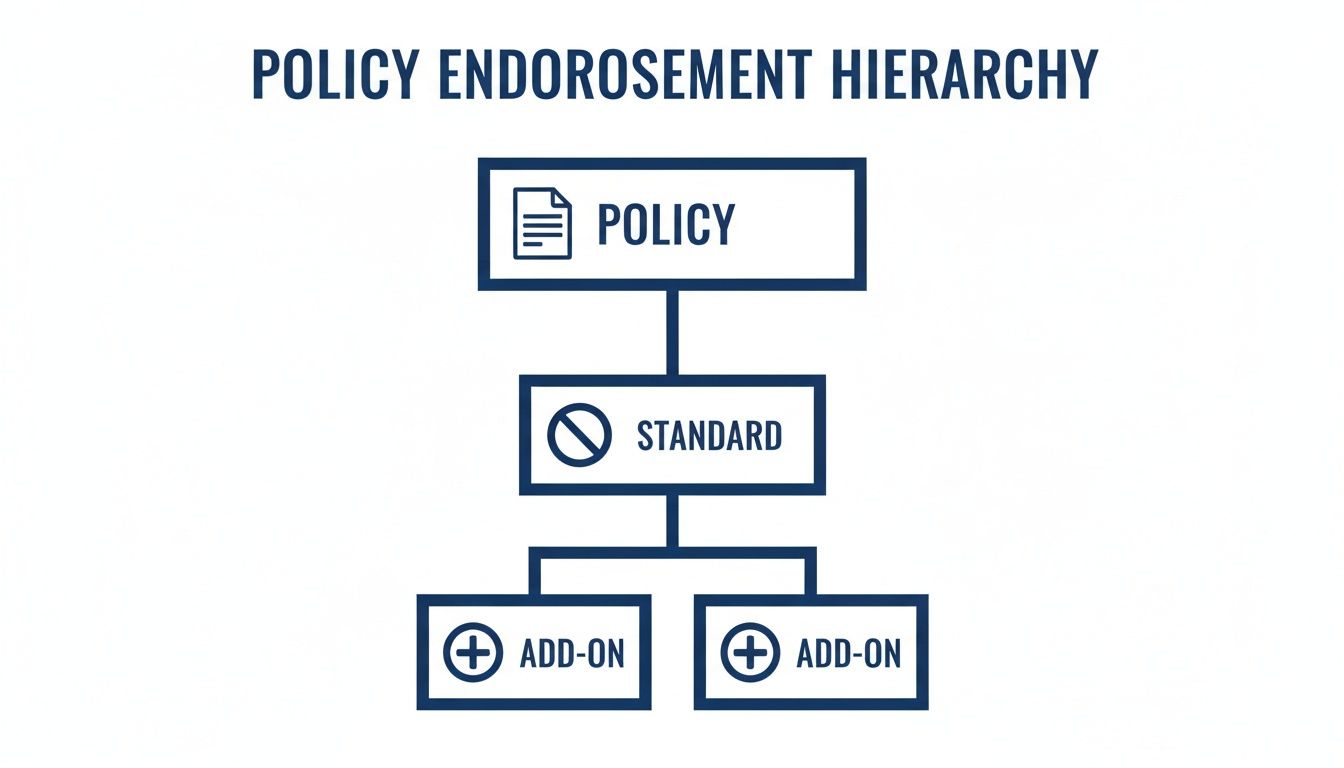

The diagram below shows how a standard, off-the-shelf policy is rarely enough. It needs specific add-ons or endorsements to become fit for our purposes.

This hierarchy makes it clear: standard cover is just the base layer. Real protection for an expedition is built by adding specific, relevant endorsements for every single activity you have planned.

Red Flags to Watch For

As you vet providers, certain signs should immediately raise concern.

Vague or ambiguous wording around covered activities is a significant red flag. If the policy doesn’t explicitly name your activity—for example, " unsupported polar ski touring "—you have to assume it’s not covered. Don't give them any room for interpretation.

Another warning sign is low coverage limits, especially for medical evacuation. Anything less than £5 million for a polar expedition is inadequate. Also, be wary of broad exclusions for " professional " or " organised " expeditions, as this vague language can sometimes be used to deny claims for trips just like ours.

The demand for this kind of specific cover is changing the industry. The UK travel insurance market is projected to grow from USD 2.22 billion to USD 4.21 billion by 2030 , driven largely by adventurers seeking proper protection. Your goal is to find a policy that reflects this new reality, not one that’s stuck in the past.

Understanding Your Cover Through Realistic Scenarios

Reading policy documents can feel like trying to navigate a whiteout. It’s all clauses and definitions, with no real sense of what it all means on the ground. To make it real, let's step away from the fine print and into the field.

These scenarios aren’t about dramatic tales. They are about what happens when things go wrong and how a solid plan, backed by the right insurance, quietly and efficiently solves the problem. This is what good risk management looks like in action.

Scenario 1: The Whiteout Evacuation

Imagine you're on a Greenland ice cap crossing. Visibility is poor. A team member falls hard, and you suspect a femur fracture. They are immobilised, wrapped in a survival bag to stay warm, and your expedition leader gets on the sat phone. They call the 24/7 assistance line, giving them your exact coordinates: 68° 43' 15" N, 44° 16' 47" W .

This is where a specialist insurer earns its keep. The assistance company knows Arctic logistics. They coordinate with local teams, and within hours, a helicopter is on its way. The Search and Rescue part of the policy covers the cost of finding and retrieving your team member. The airlift to a hospital in Nuuk? Covered by high-limit medical expenses. The medically-equipped flight back to the UK? All arranged and paid for.

Without this cover, you are looking at a bill that could top £150,000 .

Scenario 2: The Damaged Pulk

Your team arrives in Punta Arenas, Chile, ready for an Antarctic expedition. You go to collect your freight, only to find one of the specialist pulks has been damaged by the airline handlers. It’s unusable—a piece of equipment worth over £1,000 .

A standard travel policy’s baggage cover, with its single-item limit of maybe £250 , wouldn't even touch the sides. But your specialist policy has high-value equipment cover. You take photos of the damage, file a report with the airline, and call your insurer. The policy covers the cost of sourcing a replacement locally, meaning the expedition goes ahead on schedule. It’s a perfect example of why declaring and insuring your equipment is non-negotiable for trips like The Last Degree to the South Pole.

Scenario 3: The Cancelled Expedition

Two months before a planned ski crossing in Svalbard, a participant receives bad news. A serious family medical emergency means they have to pull out. They’ve already paid the final balance for the trip, an investment of over £8,000 .

This is precisely where a robust trip cancellation clause proves its worth. It protects the significant financial and emotional investment made months, or even years, in advance of an expedition.

Without the right cover, that money would simply be lost. Instead, they contact their insurer to start a cancellation claim. They send over the necessary paperwork—a doctor's letter about the family emergency and the invoices from the expedition organiser. The insurer processes the claim and reimburses them for their non-recoverable costs. This allows them to focus on their family without the added burden of a significant financial loss.

What to Do When Things Go Wrong: The Claims Process

When something goes wrong in a remote place, a calm, methodical response is everything. Stress is a given, but a messy claims process shouldn’t add to it. The procedures are there for a reason; following them is as much a part of expedition discipline as setting up a tent in a gale.

Think of the claims process not as a battle, but as a sequence of clear, logical steps. The mindset we teach—procedural, calm under pressure—applies here just as it does on a glacier.

Immediate Actions in the Field

The moment an incident occurs, your first priority is always safety. Once the situation is stable, what you do next sets the tone for the entire insurance process.

-

Contact Emergency Assistance First. This is non-negotiable. Before you incur any major costs, you must call your insurer's 24/7 emergency assistance line . They will authorise expenditures like medical treatment or an evacuation, which ensures they’re covered. Acting independently can give them grounds to reject the claim.

-

Document Everything. Create a detailed written record of what happened. Note the time, date, exact coordinates, and conditions. If anyone else was involved, get their details.

-

Gather Evidence. Use your phone or camera. Take photos of injuries, damaged equipment, or the incident location. The more visual proof you have, the more solid your claim will be.

Managing the Paper Trail

Once you’re out of immediate danger, the admin begins. This is where many legitimate claims fall apart—sloppy record-keeping.

Your goal is to build an undeniable file of evidence. This is where a methodical expedition mindset pays off. Keep a dedicated folder, physical or digital, for every single document and email.

Treat your claim documentation like an expedition logbook. Every receipt, report, and email is a critical entry that tells the story accurately and provides the evidence the insurer needs to approve your claim.

A useful tip: photograph all your high-value kit before you leave home. Having a dated photo of your Hilleberg tent or expedition-grade skis makes proving ownership simple if it gets lost or damaged.

Specialist policies are constantly evolving. Some insurers, for example, now offer specific upgrades like cover for hired ski equipment, catastrophe cover, and even hijack/kidnap provisions. It’s worth exploring these enhanced protections to see how the industry is adapting.

Be aware of the timeframe for submitting a claim, which is typically 28-30 days from the incident. Do not delay. By following these steps with precision, you turn a potentially stressful process into a manageable set of tasks, ensuring your travel insurance for adventure travel does exactly what you paid for it to do.

Your Adventure Insurance Questions, Answered

Even with thorough preparation, a few questions about insurance always remain. Here are the most common ones we hear from people gearing up for a Pole to Pole challenge, with straight answers based on years of experience.

Will My Annual Multi-Trip Policy Cover a Polar Training Course?

Almost certainly not. The moment you step onto a glacier in Norway or Iceland for training, you have left the world of standard holiday insurance far behind. Most annual policies draw a firm line when it comes to activities, altitude, and proximity to the nearest road.

Read the policy wording. You’re looking for specific exclusions around ‘winter sports’, ‘ski touring’, or travel to Arctic regions. You will need a specialist endorsement or a dedicated travel insurance for adventure travel policy to cover the risks involved in our training programmes.

What’s the Right Level of Medical Evacuation Cover for Antarctica?

This one is non-negotiable. For any trip to Antarctica, you need a policy with a minimum of £5 million for emergency medical evacuation and repatriation. That figure is not arbitrary; it reflects the reality of polar logistics.

Getting someone off the continent is not like calling a local ambulance. It's a complex operation involving medically-equipped aircraft and multiple agencies, and the costs are high. Skimping on this part of your cover is a huge, potentially life-altering financial gamble. It's the first number we tell people to check.

An Antarctic medical evacuation is not a simple airlift. It is a complex operation with an extreme price tag. Your insurance limit isn't just a number on a page—it's the real-world budget for getting you home safely.

How Do I Handle Pre-Existing Medical Conditions?

Be completely honest. You are obligated to declare every single pre-existing medical condition to your insurer when you apply. That means anything for which you've had treatment, medication, or advice in the past.

Failing to declare something, even if it seems minor, can void your entire policy when you need it most. Specialist insurers are used to dealing with this and can often provide cover for well-managed conditions, but it will always involve a proper medical screening. It might increase your premium, but that’s the price for honest, reliable protection that will pay out. There are no shortcuts here.

Your expedition is a significant investment. Protecting it with the right insurance isn't just a box-ticking exercise; it's the mark of a serious, properly prepared explorer. The team here at Pole to Pole is ready to help you plan your next challenge, from the first training session to the final step.